A financial reality check for physical preparation coaches

Irrespective of the motivations that drew you into this industry, there’s a probability that at some point in time you are going to reflect upon the low incomes that constitute most roles in this industry. Put simply this is one of the lower paying ‘professions’. Not totally surprising considering one of the more popular roles within the industry, that of a personal trainer, is the current go to for anyone who is not sure what they want to do with their life, or a waiting for a break in another industry.

Physical preparation coaches who work as gym instructors[1] or personal trainers[2] typically earn below the poverty levels, between $20,000 to $40,000 per year. Physical preparation coaches working with athletes as ‘strength and conditioning coaches’ typically earn $30,000 to $50,000 per year[3] at the college level. Some can earn $75,000 to $150,000 a year in the professional sports ranks.[4] A few earn higher.

Where does this place the physical preparation profession relative to the rest of the work force in developed countries such as America, Europe and Australia? Here’s a statistic from the United States.

Based on the Internal Revenue Service’s 2010-2014 database below, here’s how much the top Americans make: [5]

Top 1%: $380,354

Top 5%: $159,619

Top 10%: $113,799

Top 25%: $67,280

Top 50%: >$33,048

If we were to make a median income in physical preparation, I believe it would be below $33,000 US/year. In other words, the majority of physical preparation coaches are in the bottom 50% of income earners.

For those who plan to make a life long career, and in particular for those who plan to or do support a family, there’s a real challenge with income.

I have sensed a belief or perception with physical preparation that being a physical preparation coach means you need to forgo financial success, because we are little more than a community service. Granted the recent history of this industry has been volunteer-based, but those days are gone.

You don’t have to remain poor because you chose to be involved in physical preparation as a coach![6]

Yes, the average incomes within the industry are a factor dragging the sector. However another factor holding back incomes in this industry is the lack of financial education.

Based on the responses I have received from physical preparation coaches (personal trainers, strength coaches, strength and conditioning coaches etc.) to a ‘financial health’ questionnaire I have developed it really clear that some clarification would benefit those in the industry.

I appreciate that it all comes back to definitions and it’s not appropriate to use the right and wrong approach to how a person defines themself, what they do or what they have. So I will provide the definitions I subscribe to in each point. I also appreciate the sensitive nature of money and the ego, so I am going to be as gentle as I can.

Here are at seven things about your financial position that I believe deserve ‘attention’

1. You don’t own a business!

One of the questions in the survey where the answers really shocked me were how many physical preparation respondents ticked yes, they have business. Now from where I sit I am going to assume they are self-employed, and or have a trading name or entity, and that gives them the belief they have a business. (Yes, I appreciate that the small minority actually do own a business, and we will touch upon that shortly)

I thought like that once. Until I was exposed to some simple but powerful concepts that helped me understand that being self-employed is not being a business owner.

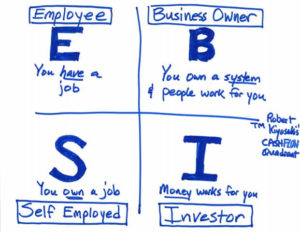

Firstly lets look at it from the perspective of Robert Kiyoski’s cashflow quadrant. On the left hand side of the quadrant you find the employee (E) and self-employed (SE). What they have in common is they both sell their time. On the right hand side of the quadrant you the business owner (B) and the investor (L). What they have in common is they have leverage. The business owner typically leverages off other peoples time (OPT) (e.g. services) and or the sale of products, and the investor typically leverages off money, including other peoples money (OPM). I will discuss what ‘leverage’ is shortly.

Now before you talk yourself into the possibility that what you do places you on the right hand side of the quadrant not the left, I want to introduce a second perspective on the definition of ‘business’, one I learnt from Brad Sugars.

A business is a commercial, profitable enterprise that works without you.—Brad Sugars

The key word is without you. You are not at work and you are making money. You can potentially receive income whilst you sleep from efforts other than your own (ironically another question in the financial survey where the typical answers give were the catalyst for this article!) . And yes, I understand some of you ‘have trainers’ and believe this describes you – give me time, I will address that.

So unfortunately, based on the definitions I rely upon, you don’t have a business!

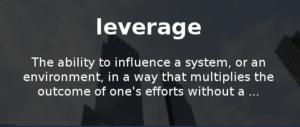

2. You don’t have leverage

Leverage is typically used to describe the phenomenon of achieving a greater result than the effort put in. When used to describe income, leverage is one of three types of income – earned, leveraged and passive.

Earned income occurs when you sell your time for money. If you don’t work, you don’t get paid, and once you have done the hour and been paid, there is no more money for that effort. This is what the majority of physical preparation coaches do. They don’t have leverage.

Their income is limited to the hours they can work, and is non-existent if they don’t or can’t work or if the client does a no-show.

Leveraged income can be defined as doing something once and getting paid for it over and over again. Minorities within the industry have leveraged income and the methods typically used to achieve leverage warrant further discussion. Suffice to say, how many physical preparation coaches do you know retired early and living permanently on the beach in Hawaii or similar because of their success in leveraged income?

Bottom line – without leverage, your ability to substantially increase your income is very limited, and your ability to have time freedom nearly non-existent.

Leverage is the reason some people become rich and others do not become rich.–Robert Kiyosaki

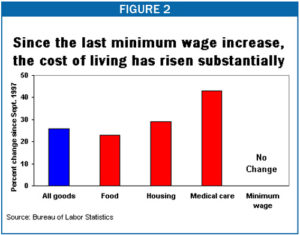

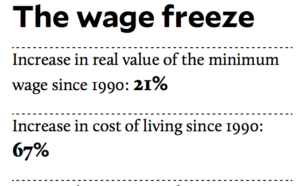

3. Your income does not rise faster than the rate of inflation

One of the biggest financial challenges we all face is the impact of inflation or rising cost of living on the value of our dollar. Is your income rising faster than the rate of inflation.

This is tougher for the relatively younger person in the workforce to answer as they have not been around long enough to assess the tradeoff between the increase in cost of living and increases in their earnings. More experienced physical preparation coaches are in a far better position to comment on this.

Now keep in mind we are not talking about the changes that will occur in the demands on your income if you are supporting another per

son/persons, as is the case if you were to start/or have a family.

The chart provided shows the cost of living rises in the US since 1997 – almost 30%. So what was the change in minimum wage in that time? 0%.[7] The table below that goes back to 1990. [8]

You can do your own sums on this – do you have more or less disposable income than you had 5, 10, 20 or 30 years ago? Which raises the next question for you – do your current income streams have the ability to increase your income at a rate that exceeds the rate of rise in cost of living? I suggest it does not and will not – unless of course you change.

4. You don’t have sufficient retirement savings

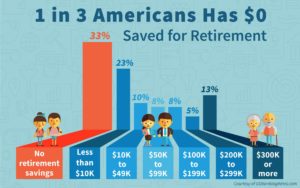

If you stopped work today, by circumstances or choice, could you support yourself financially for another few decades at a standard of living you would be happy with. Here are some 2016 stats relative to the US on retirement:[9]

- One-third of Americans report they have no retirement savings.

- 23% have less than $10,000 saved.

- This means that 56% of Americans have less than $10,000 saved for retirement!

If you calculate a very, very basic cost of living for a single person at say $25,000 per year, and expected to live an average of twenty years in retirement, you are going to need at least $500,000 in savings, placing you in the top 13% of all Americans regarding their retirement savings currently.

If you were spending the savings you could survive at that standard of living for 20 years (not withstanding any extra medical costs – which are going to be inevitable if you live to the full term of your natural life); or you could hope to invest your 500k in an interest-bearing instrument producing 25k a year.

How many years could you support yourself in retirement on your current savings or investments?

How many years could you support yourself in retirement on your current savings or investments?

5. You are not immune to being replaced by a robot

Another answer to a question in my financial health questionnaire related to a person’s confidence that their income was future proofed, devoid from threat of being made redundant by robots (or other technology) or shifts in global trends such as certain labor going ‘off-shore’.

Some believe that they were immune to this. Let’s talk about technology first. If your decision making in your service is limited i.e. no high level discernment or creativity is involved, you are very replaceable by technology.

I am going to be perhaps hurtfully blunt – what most physical preparation coaches do is lacking in the high level thinking that would prevent a robot from taking their place. The only real attraction for most clients is that you are a person with a heartbeat not a robot. However that will not save any profession at risk of being replaced by robots.

6. You’re not unique

Your lack of uniqueness means a number of things. Firstly a robot can replace you. Secondly you are just like everyone else, leaving you wondering why you can’t get standout demand for your services.

The challenge for many is to understand the concept of UMP – unique marketing position (or USP, Unique Selling Position). Dying your hair or wearing dreadlocks or flashing your guns does not make you unique in the sense of UMP. Nor does a twist in your marketing.

The kind of uniqueness I suggest pays is most effective in the physical preparation industry (in fact in most of not all service industries) is your level of competence and subsequent ability to make a massive difference in people’s lives.

This I suggest comes from the higher levels of competence, you with a focus on being the best you can be. Not being like or liked by everyone else.

Here’s the irony – most prioritize being liked by others, and to do this you need to be ‘like’ others. How do you expect to get a superior outcome if you train people like everyone else does?

My reality is that competence threatens. As my coaches progress through and up the levels of competence, their former work colleagues will turn on them. They are typically ejected from their workplace, some with the use of police called in by their previous colleagues. Certain things happen when your competence gets to a certain level. I celebrate them as signs of greatness!

When you stop being like other people, other people will stop liking you!–Darren Hardy

If you haven’t been kicked out of your former working environment, you haven’t raised your competence level to the extent that you could!

7. You’re not an entrepreneur

Put simply and generically, you are not an entrepreneur. The most poignant use of the word ‘entrepreneur’ that I have seen in my four decade career in this industry was a young man who had recently left the security of his employment in a non-related industry to take up his long held dream of being a full time self-employed physical preparation coach. Shortly after that live move he was diagnosed with cancer. In his online fund raising page he talked about how his life collapsed upon his diagnosis, and his lack of income and medical insurance was because he had chosen to become ‘an entrepreneur’.

No he had not become an entrepreneur. Rather, he had simply moved from the E quadrant to the S quadrant. Not that I felt it was responsible to share that with him at that time. At that, as I do with many life-impacting conclusions I reach, committed to in the future helping physical preparation coaches be forewarned and educated, before they were put in these serious situations.

Sorry, but you are not an entrepreneur.

Conclusion

As I said at the start money is a tender topic intertwined with pride and ego. I have sought to be respectable and gentle yet at the same time straight with you. Yes, I have made generalizations. Yes, I may have upset a few. All of this is worthwhile if I have helped a few reflect upon any misguided conclusions they may have reached about their financial future.

To help you I have developed a short course providing vital much-needed entrepreneurial education. The next program starts at the beginning of next month. If you are interested, email us at question@kingsports.net.

This industry is already one of the lower earning industries in the developed world. Continuing to operate in an environment devoid of financial education is not helping. If you truly want to become more entrepreneurial and are willing to empty your cup (figuratively speaking) this course presents a great starting point!

——-

[1] http://www.fitnesscareers.com.au/newsview/fitness-salary-guide-38

[2] http://www.fitnesscareers.com.au/newsview/fitness-salary-guide-38

[3] by Rick Suttle, Demand Media, http://work.chron.com/much-strength-conditioning-coaches-make-average-19363.html

[4] Careers in Sport, Fitness, and Exercise, By American Kinesiology Association, Human Kinetics http://www.humankinetics.com/excerpts/excerpts/strength-and-conditioning-coach

[5] http://www.financialsamurai.com/how-much-money-do-the-top-income-earners-make-percent/

[6] King, I, 2005, The Way of the Physical Preparation Coach, p. 165

[7] https://buffalogrumblings.wordpress.com/tag/minimum-wage/

[8] https://www.motherjones.com/politics/2011/05/speedup-americans-working-harder-charts/

[9] Kirkham, E., 2016. 1 in 3 Americans have saved $0 for retirement, Gobankingrates, 14 March 2016, http://time.com/money/4258451/retirement-savings-survey/